Posted on: August 02, 2021

Harness the power of advanced analytics, robotic process automation and blockchain to transform Trade Finance

Trade Finance represents financing for trade, and it connects both domestic and international trade transactions. A trade transaction implies both a seller and a purchaser of goods and services. These transactions may be done through intermediaries, such as banks and financial institutions.

The global Trade Finance market size was estimated at USD 8942.27 Billion in 2019, but because of Covid-19, the market dropped to USD 7616.52 Billion in 2020, and it is expected to rise to USD 10426.67 Billion by the end of 2026, growing at a CAGR of 5.37% during the prediction period 2020-2026.

Nearly 80 to 90% of world trade depends on trade finance, including trade credit and guarantees. Exporters and importers from less-developed countries must pay very high fees, which raise their exchange costs. In contrast, low-interest rates and fees offered by international banks favor traders from developed countries

Key Challenges:

- Trade Finance is paper-heavy and the most laborious segment in banking. The International Chamber of Commerce (ICCC) estimates that upwards of 4 billion pages of documents circulating in the documentary trade. The current manual paper-based is always prone to the risk of human errors and a slower verification process.

- A typical trade transaction goes through various compliance checks during its life cycle, with each review notch up costs along the way. On average, a large trade finance bank can expend anywhere from US$25m to US$42m annually on risk, compliance, sanctions, and anti-money laundering (AML) tasks – all without growing its business.

- With multiple stakeholders at different locations, document delivery via courier or other means is very time-consuming. Consequently, a higher turnaround time at each step of the process is expected, from initiation to LC submission. As the documents move through multiple touchpoints, they can be tampered with or lost in transit and other challenges are security, and lack of trust.

Why Automate the Trade Finance?

Usually, for banks, Trade Finance constitutes about 40% of their annual revenue, which is quite a significant figure. It is common for banks to have thousands of people manually processing thousands of trade documents related to each deal. A considerable bank in the Asia Pacific has 3,500 people manually processing documents of trade. Around the globe, every day in banking institutions, Trade Finance organizations struggles to process the respective paperwork with a trade. With such enormous investments/spends, an increase of efficiency, in any way, can produce a competitive advantage and significant savings to the bank. Moreover, with an efficient process for managing Trade Finance, banks will have the capability to market to the field, driving new business.

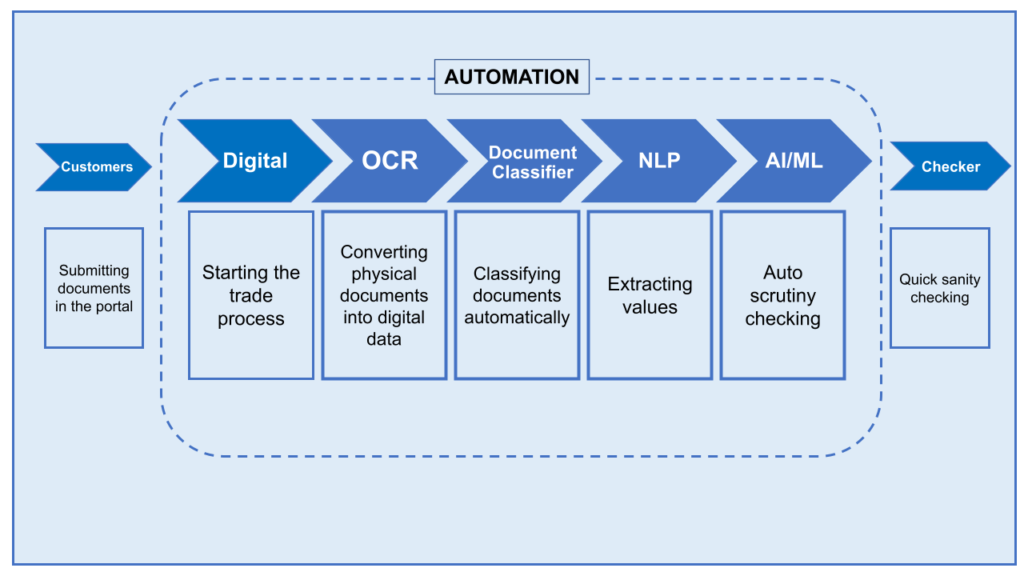

Automation – RPA, NLP, AI & ML

Paper to Digital

The one that is most common is using document digitization using OCR (Optical Character Recognition) to transform text in image to digitally readable text.

Classification of the Processed Documents

Documents which are scanned into the workflow, could be done in batches, or the order does not need to be consistent. As the system classifies the documents, it adds another layer of automation to the workflow which makes it easier for the maker to process them.

Data Extraction

This still does not put an end to the need for “makers” to manually enter the data, although the effort marginally goes down because she/he can now copy and paste the values into the Trade Finance application. But what if we could have a system that could do the value extraction on its own without needing the maker to do all the work? Natural Language Processing (NLP) comes into the situation here to enable this capability of extracting values from the semi and unstructured text.

Automate Scrutiny checks using ML

Taking into account the value of the Trade Finance deals, it is imperative for banks to do several review checks, e.g., name validation across documents, anti-money laundering check, etc. These can be automated further using rules and AI/ML techniques.

Executing various Red Flag Indicators (RFI) and Scrutiny checks can be automated leveraging Machine Learning based on historical data and user feedback.

Interactive Interface (for the customers)

In the post-pandemic world, it is difficult to replace the branch as the channel to the Trade Finance application process. A number of banks have begun providing digital portals for clients to submit applications online. Although this has served the purpose of taking out the branch being a hold-up (usually many back & forth communications are required between bank & customer before the application is complete), it has mainly moved the hold-up to the operations. So, the ability to create intelligence into the digital to do the evaluation, checks and comparison to avoid time lost in back & forth interactions, is required. Interacting with the client in a human-like conversational manner to guide the customer to get the application submitted properly. Possibly extending the channels to others through email, WhatsApp.

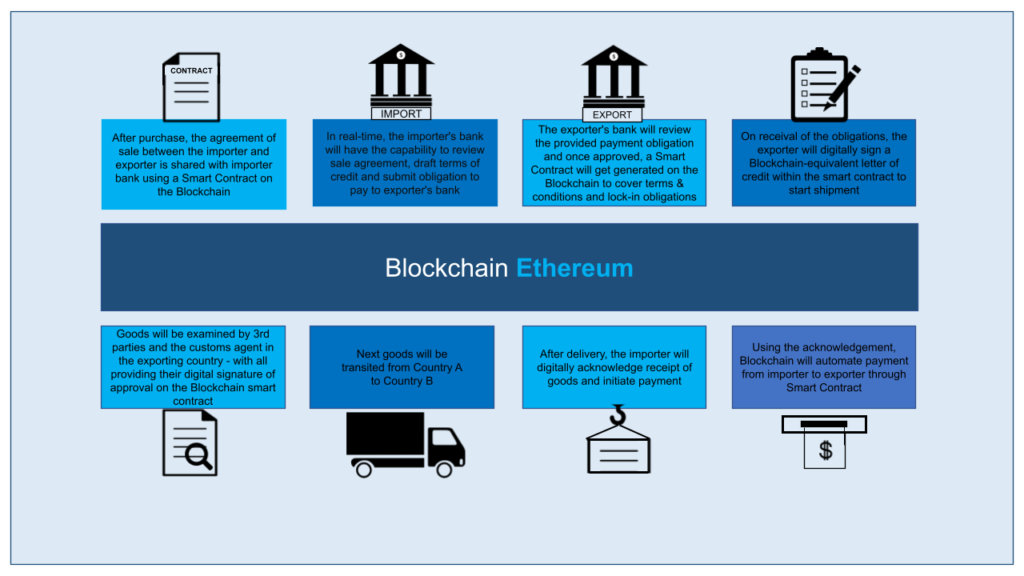

Smart Contracting using Blockchain Ethereum

The COVID-19 pandemic has had a devastating effect on economies and societies worldwide, because of which adoption of automation is increasing exponentially – enhancing accuracy and security. Connect with us to know how we can help your organization in Automating Trade Finance – from start to finish.